Tracking freelance income sounds simple, but in reality it often turns into a mess of spreadsheets, bank statements, and half-finished accounting setups.

Most freelancers or solopreneurs don’t struggle because they’re bad with money, they struggle because the tools available are far more complex than what they actually need.

If you’re a freelancer, solopreneur or just running side projects to make money, the goal isn’t accounting perfection.

It’s clarity… You want to know what you’ve earned, what’s been paid, what’s outstanding, and how your income is trending over time… That’s it.

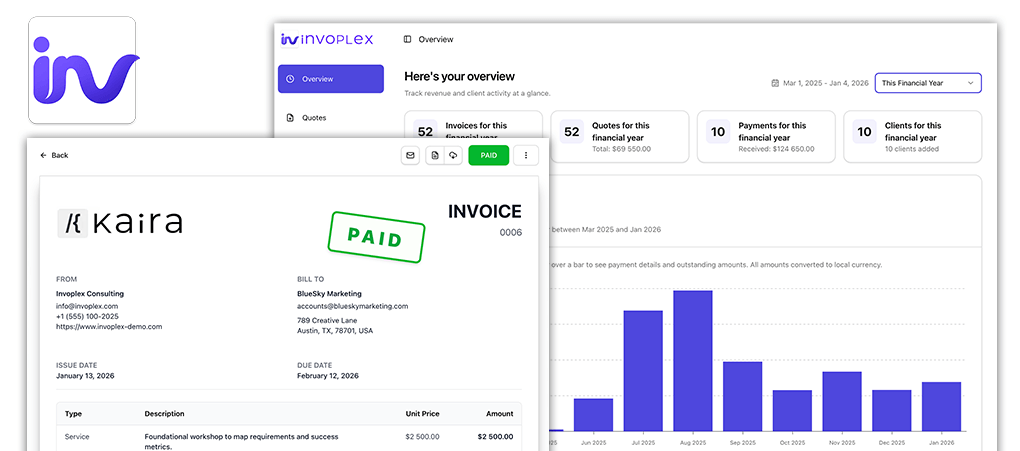

Here’s a simple way to track freelance income without overcomplicating things… Use Invoplex.

Why Freelancers Struggle to Track Income

Most freelancers start out with good intentions.

Maybe you use a spreadsheet, notes app, or online banking to track payments, and while that works for a while…

Problems usually appear when:

- You work with multiple clients

- You send quotes before invoices

- Payments come in at different times

- You run more than one side project

Suddenly, it becomes hard to answer basic questions like:

- How much did I earn this month?

- Which invoices are still unpaid?

- Which clients bring in the most income?

Traditional accounting software promises to solve this, but it also introduces a bunch of new problems: setup time, accounting jargon, and bloated features you’ll probably never use as a freelancer or soloepreneur. All you need is simple invoicing software.

What You Actually Need to Track Freelance Income

For most freelancers, income tracking comes down to a few essentials:

- Invoices sent

- Payments received

- Outstanding invoices

- Income totals per month or project

- Client history

You don’t need balance sheets, tax reports, or complex financial dashboards just to understand your income.

You need an income tracker that connects quotes, invoices, payments, and clients in one place.

This is exactly the gap Invoplex was built to fill.

The Simple Way to track Income Through Invoicing

The easiest way to track freelance income is to tie it directly to your invoices.

Instead of logging numbers manually, your income tracking should happen automatically when you:

- Create a quote

- Convert it into an invoice

- Mark it as paid

When everything flows from quotes to invoices to payments, income tracking becomes effortless.

With Invoplex, every invoice you send and payment you receive contributes to a clear view of your earnings.

There’s no separate system to maintain and no duplicate data entry.

Why Spreadsheets Stop Working

Spreadsheets feel simple at first, but they break down fast.

They require:

- Manual updates

- Constant checking

- Discipline to stay accurate

Miss a payment update or forget to log an invoice, and your income numbers are suddenly unreliable. Over time, freelancers stop trusting their own tracking system.

Using a dedicated freelancer income tracking tool like Invoplex removes this friction. Your income updates itself as you work, which means fewer mistakes and better visibility.

Tracking Income Across Side Projects

If you run side projects alongside client work, tracking income gets even trickier.

You might have:

- Different pricing

- Different clients

- Irregular payment schedules

Invoplex makes it easy to track income across multiple projects while keeping everything organised by client and invoice.

This gives you a clear picture of what’s working, what’s growing, and where your time is paying off.

For freelancers or soloepreneurs juggling client work and side projects, this clarity is invaluable.

Keep It Simple and Consistent

The key to tracking freelance income isn’t complexity, it’s consistency.

Choose a tool that:

- Is easy to use daily

- Doesn’t overwhelm you

- Shows your income clearly

- Grows with your freelance work

Invoplex was designed for freelancers who want a simple way to track income without turning into accountants.

It keeps everything focused on getting paid and understanding your earnings, not managing software.

Final Thoughts

If you’ve been wondering how to track freelance income without spreadsheets or bloated accounting tools, the answer is simpler than you think.

Track income through your invoices.

Keep everything in one place. Use a tool built specifically for freelancers.

That’s why I built Invoplex, to make income tracking something you don’t have to think about, so you can focus on the work that actually earns you money.